AML-How to pass?

HOW TO PASS THE GOVERNMENT’S ANTI MONEY LAUNDERING (AML) LAWS

The law was introduced to help stop criminal gangs using the purchase of property to commit identity theft as well as steal and launder money. Breach of the Anti Money Laundering (AML) laws carries up to 14 years imprisonment and an unlimited fine, into the tens of thousands. That’s why many firms won’t even start properly working until their client passes

Checkboard gives you the following benefits;

1. You get an additional 5 working days to pass (rather than 1 day),

2. Less risk of fraud attack

3. Less risk of identity theft

Why do we only work with clients using Checkboard?

To reduce your risk criminal attack (and you losing the hundreds of thousands of pounds involved in your property transaction), we now only work with clients who use the secure Checkboard app which uses government backed secure open banking technology.

You don’t get the Checkboard level of protection where other lawyers allow you post or email your passport, driving licence, utility bill and bank statements which can be forged within minutes by criminal gangs intercepting these.

For your protection and reassurance.

Note 1. AVRillo will regrettably stop working if you can’t use Checkboard, as, without it, you don’t have the protection of Open banking technology, True Layer data nor FCA (Financial Conduct Authority) regulation. By using Checkboard you benefit from these regulated strict rules and stringent standards that keep you data safe.

Note 2. You can read about Open banking data security: https://www.openbanking.org.uk/about-us/ and

Note 3. You can read about True Layer data security also used byb/check board: https://truelayer.com/

NEXT STEPS & FAQ

Just 5 to 10 minutes to go through Checkboard

Just 5 to 10 minutes for you to go through the Checkboard steps. Once we receive their report it should take 5 working days for our AML anti laundering compliance team to assess if your Checkboard information passes the government requirements.

Those lawyers (not us) still accepting paper documents can take months to pass; thereby delaying your case as well increasing your risk of loss into the hundreds of thousands. We would rather not act for you if you want to take that risk, than exposing you to the risk of paper documents. I hope you understand.

Steps & Conditions to use Checkboard?

Steps and Conditions to use Checkboard

Step 1. I must only use the mobile number I set out in my instruction form. I understand; for security purposes, no other mobile will work.

Step 2. I must live in the UK, and my money must be in a UK bank account.

Step 3. I will press the link Checkboard text to download their app from the Google Play Store or the Apple Store. If I am selling and buying, I will press both Checkboard links: the first on their sale text to me; the second on the purchase text they send.

Step 4. I will prove my ID and address by using the app to: 4.1) take a selfie, 4.2) a video of myself, 4.3) upload (i) my bank statement from where my money in and out for my transaction will be transferred; (ii) my passport (signature & photo page), (iii) my driving licence (only if I have one).

Step 5. If I am buying, I will click here to check that my bank is in the top 78 banks that use the government bank Open banking technology, which integrates with Checkboard.

Step 6. On a sale, I must upload supplementary documents, if I:

6.1 If I don’t live at the sale property[bg_collapse view=”link” color=”#7cac44″ expand_text=”Show More” collapse_text=”Show Less” ]If I reside in a care home (I must upload a letter confirming this from the care home), or if the property is a buy to let (I need to upload a document in my name but addressed to the sale property, such as a building insurance policy, or mortgage statement or a service charge bill).[/bg_collapse]

6.2. If I sell as an Executor (Personal Representative)

[bg_collapse view=”link” color=”#7cac44″ expand_text=”Show More” collapse_text=”Show Less” ]I must upload a Grant of Probate. [/bg_collapse]

6.3. If I sell under a Power of Attorney (e.g., the seller is without full mental capacity) [bg_collapse view=”link” color=”#7cac44″ expand_text=”Show More” collapse_text=”Show Less” ]I must upload the Power of Attorney and a GP letter confirming the property owner lacks mental capacity. [/bg_collapse]

5 day deadline to pass AML

Ideally, the day you instruct your lawyer or within a maximum 5 extra working days.

On the 6th day your file must be closed if you don’t pass, to protect you against fraud, a risk of a up to a £10,000 fine and 14 years imprisonment.

Do I have a choice?

No, not with us. We need to protect you so we only accept clients who use Checkboard as this reduces their risk of loss. For those wanting to take a higher risk of fraud attack, you can still choose a lawyer prepared to allow you to send paper or online documents putting you at risk of identity theft as well as the losing the hundreds of thousands of pounds involved in your purchase.

For your added security, that’s why we now only use the FCA regulated Checkboard, safely looking after your data using the government backed Open Source banking technology.

14 year’s imprisonment & £10,000 penalty

Criminal offence – imprisonment term

| Amount of Money Ordered to be Paid | Maximum Term for Proceeds of Crime Act Sentencing |

| £10,000 or less | 6 months |

| More than £10,000 but no more than £500,000 | 5 years |

| More than £500,000 but no more than £1 million | 7 years |

| More than £1 million | 14 year |

Is Checkboard safer than paper?

Yes. The Checkboard app is more secure because:

1) Checkboard is regulated by the Financial Conduct Authority (FCA),

2) Checkboard uses biometric software (similar to the passport office),

3) Checkboard uses the government-backed Open Banking technology, and

4) Checkboard has integrated with the top 78 banks (via the banks’ “true layer” system).

In contrast, lawyers who still allow clients to send paper documents put them at a much higher risk of fraud attack because they can be forged in minutes, whether sent by email or post. That’s why we now only work with clients who use the Checkboard app, which uses secure government backed open source banking technology.

Is my bank on the list (buyer only)

CHECKBOARD STEP BY STEP GUIDE TO PASSING AML

Sale AML check - How do I pass?

Email: Tap the grey box to enter your email. You can tap outside the box or press done to confirm the email address

Step 1: Tap in the box

Step 2: Enter your email address

Step 3: Save by tapping update

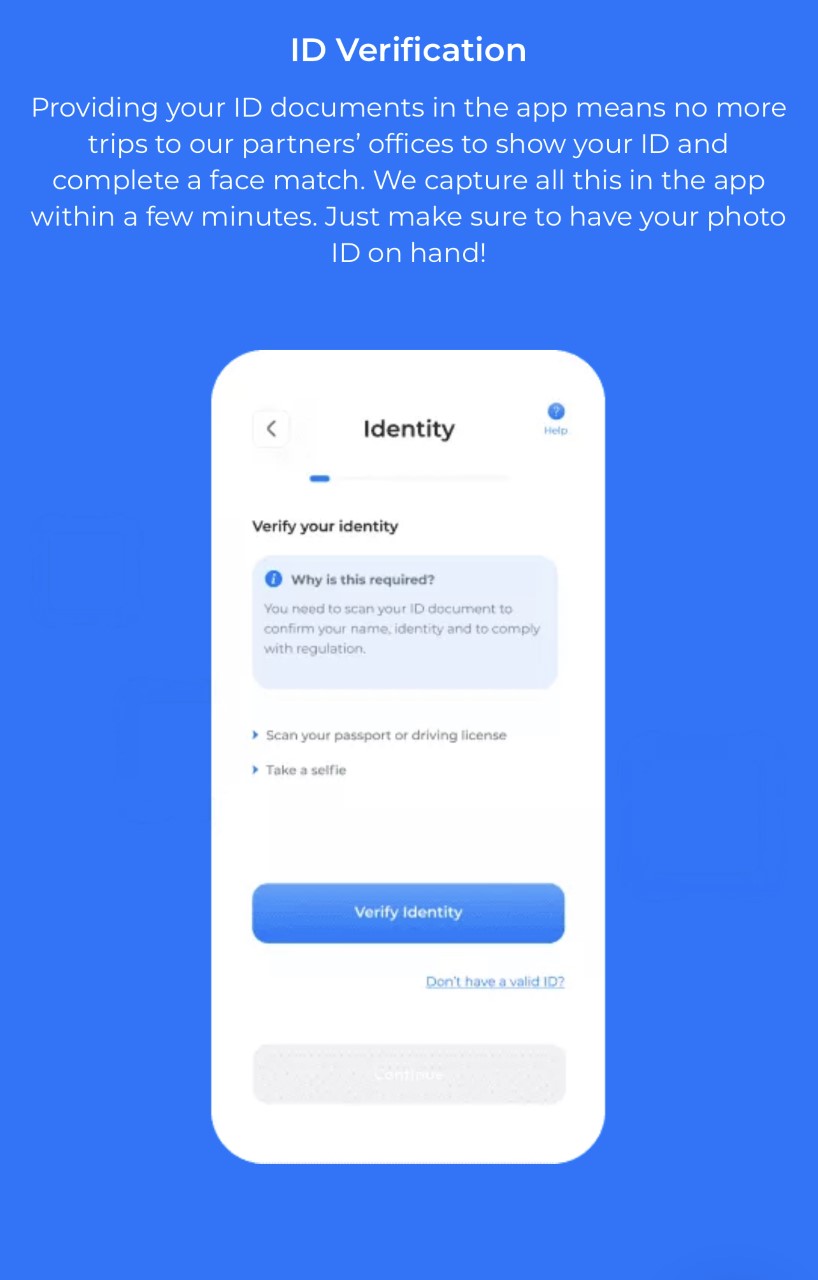

ID: Ensure you have the original in-date passport or driving licence before starting this check

Step 1: Make sure you can scan the document on a neutral surface. This image, which sometimes includes the background, will be uploaded to your report

Step 2: Now that you are in a room with sufficient lighting and a neutral surface to place your document, let’s start scanning!

select the issuing country of the ID you will be scanning

next, select the correct issuing country. Please select the document type. I.e. Either passport or driving licence

Step 3:

scan the ID, and make sure the whole page fits within the frame. You want to make sure the photo captured is not blurry, not glary and not cropped

next, scan your face, ensure the room is bright and that your face fits within the frame

You don’t have a valid ID?

Regrettably, we won’t be able to carry out the checks without a valid ID. Please refer back to your solicitor or estate agent. They should be able to advise a different way to carry out the checks with the IDs you may have available.

Address

If you reside in the UK, follow the steps below

-Select UK in country

-enter the postcode

-select the address from the list of addresses

-select yes if this is a current address or no if it’s a previous address

If you don’t reside in the UK, follow the steps below

-tap on the country to select the correct country

-enter the address line 1

-enter the address line 2 (optional)

-enter the city

-enter the postcode or zipcode

-select yes if this is a current address or no if it’s a previous address

To add more addresses, please tap on add address and repeat the steps

Document upload: You can upload documents to provide further evidence for things such as proof of address, employment, source of funds, etc.

Follow the steps below if you need help with uploading your documents:

Step 1: Select the type of document you’d like to upload

Step 2: Select the source of the document. You have the camera option in case you want to take a picture of the document

Step 3: Select the document and upload it. Wait until the upload is completed

Step 4: You can upload more documents by tapping on Add more documents or if you’re happy with the document provided, you can press continue

Purchase AML - How do I pass?

Email: Tap the grey box to enter your email. You can tap outside the box or press done to confirm the email address

Step 1: Tap in the box

Step 2: Enter your email address

Step 3: Save by tapping update

ID: Ensure you have the original in-date passport or driving licence before starting this check

Step 1: Make sure you can scan the document on a neutral surface. This image which sometimes includes the background will be uploaded to your report

Step 2: Now that you are in a room with sufficient lighting and a neutral surface to place your document, let’s start scanning!

1.select the issuing country of the ID you will be scanning

2.next, select the correct issuing country. Please select the document type. I.e. Either passport or driving licence

Step 3:

1.scan the ID, and make sure the whole page fits within the frame. You want to make sure the photo captured is not blurry and not cropped

2.next, scan your face, ensure the room is bright and that your face fits within the frame

You don’t have a valid ID?

Regrettably, we won’t be able to carry out the checks without a valid ID. Please refer back to your solicitor or estate agent. They should be able to advise a different way to carry out the checks with the IDs you may have available.

Address

If you reside in the UK, follow the steps below

-Select UK in country

-enter the postcode

-select the address from the list of addresses

-select yes if this is a current address or no if it’s a previous address

If you don’t reside in the UK, follow the steps below

-tap on the country to select the correct country

-enter the address line 1

-enter the address line 2 (optional)

-enter the city

-enter the postcode or zipcode

-select yes if this is a current address or no if it’s a previous address

To add more addresses, please tap on add address and repeat the steps

Banking: Solicitors and law firms must understand where the money comes from when dealing with large amounts of money to prevent money laundering and fraud

Please follow this guide to connect your digital banking successfully.

Step 1: Search for your bank in the list

Step 2: Read the consent page and press allow if you agree with sharing your digital bank statement. Please note, this action will redirect you to your bank app to finalise the task

Step 3: Once successfully connected, you will see this success screen

What happens if your bank is not listed?

If this section is mandatory by your solicitor or agent, then you should communicate to them that your bank is not listed and ask for advice in regard to the next steps.

SOF (Source of funds)

There are many ways to complete the source of funds. For some digital banking is mandatory, in which case, please follow this article on how to connect to digital banking ➡️  Banking

Banking

Once digital banking is added, please follow the steps below to add the rest of your funds.

Bear in mind, if you are a buyer, you need to add up to the total of the property’s purchase price. If part of the funds is coming from a donor, you can use the option gift. If it’s coming from a co-buyer, you can add the rest to co-buyer funds.

Step 1: Tap on add more funds

Step 2: Select where the funds are coming from

Step 3: Keep adding them until you are able to provide a clear breakdown of where the total funds are coming from

You should repeat this step until all your ‘Confirmed funds’ match your ‘Funds required’.

SOW (Source of wealth)

Once digital banking is added, and you’ve added the breakdown of the funds. You will be prompted to complete the Source of Wealth screen.

In here you get to explain in a bit more detail how the funds were obtained.

Step 1: Tap on confirm my source of wealth

Step 2: tap on begin

Step 3: You can use the template provided as a guide on how to complete SOW for each of your SOFs

Remember to provide the source of wealth for all declared funds.

Document upload: You can upload documents to provide further evidence for things such as proof of address, employment, source of funds, etc.

Follow the steps below if you need help with uploading your documents:

Step 1: Select the type of document you’d like to upload

Step 2: Select the source of the document. You have the camera option in case you want to take a picture of the document

Step 3: Select the document and upload it. Wait until the upload is completed

Step 4: You can upload more documents by tapping on Add more documents or if you’re happy with the document provided, you can press continue

Donor AML - How does my donor pass?

Email: Tap the grey box to enter your email. You can tap outside the box or press done to confirm the email address

Step 1: Tap in the box

Step 2: Enter your email address

Step 3: Save by tapping update

ID: Ensure you have the original in-date passport or driving licence before starting this check

Step 1: Make sure you can scan the document on a neutral surface. This image which sometimes includes the background will be uploaded to your report

Step 2: Now that you are in a room with sufficient lighting and a neutral surface to place your document, let’s start scanning!

1.select the issuing country of the ID you will be scanning

2.next, select the correct issuing country. Please select the document type. I.e. Either passport or driving licence

Step 3:

scan the ID, and make sure the whole page fits within the frame. You want to make sure the photo captured is not blurry and not cropped

next, scan your face, ensure the room is bright and that your face fits within the frame

You don’t have a valid ID?

Regrettably, we won’t be able to carry out the checks without a valid ID. Please refer back to your solicitor or estate agent. They should be able to advise a different way to carry out the checks with the IDs you may have available.

Address

If you reside in the UK, follow the steps below

-Select UK in country

-enter the postcode

-select the address from the list of addresses

-select yes if this is a current address or no if it’s a previous address

If you don’t reside in the UK, follow the steps below

-tap on the country to select the correct country

-enter the address line 1

-enter the address line 2 (optional)

-enter the city

-enter the postcode or zipcode

-select yes if this is a current address or no if it’s a previous address

To add more addresses, please tap on add address and repeat the steps

Banking: Solicitors and law firms must understand where the money comes from when dealing with large amounts of money to prevent money laundering and fraud

Please follow this guide to connect your digital banking successfully.

Step 1: Search for your bank in the list

Step 2: Read the consent page and press allow if you’d like to complete this step. Please note, this action will redirect you to your bank app to finalise the task

Step 3: Once successfully connected, you will see this success screen

What happens if your bank is not listed?

If this section is mandatory by your solicitor or agent, then you should communicate to them that your bank is not listed and ask for advice in regard to the next steps.

SOF (Source of funds)

There are many ways to complete the source of funds. For some digital banking is mandatory, in which case, please follow this article on how to connect to digital banking ➡️  Banking

Banking

Once digital banking is added, please follow the steps below to add the rest of your funds.

Step 1: Tap on add more funds

Step 2: Select where the funds are coming from

Step 3: Keep adding them until you are able to provide a clear breakdown of where the total funds are coming from

SOW (Source of wealth)

Once digital banking is added, and you’ve added the breakdown of the funds. You will be prompted to complete the Source of Wealth screen.

In here you get to explain in a bit more detail how the funds were obtained.

Step 1: Tap on confirm my source of wealth

Step 2: tap on begin

Step 3: You can use the template provided as a guide on how to complete SOW for each of your SOFs

Remember to provide the source of wealth for all declared funds.

Document upload: You can upload documents to provide further evidence for things such as proof of address, employment, source of funds, etc.

Follow the steps below if you need help with uploading your documents:

Step 1: Select the type of document you’d like to upload

Step 2: Select the source of the document. You have the camera option in case you want to take a picture of the document

Step 3: Select the document and upload it. Wait until the upload is completed

Step 4: You can upload more documents by tapping on Add more documents or if you’re happy with the document provided, you can press continue

Where do I find my invitation link to start my check?

You can find the invitation link in two places

In your text messages on the mobile number you’ve instructing your conveyancer on.

your email inbox.

Find below the sample examples of the checkboard invitation

Text message sample

You need to tap the link in blue that looks like https://vl.ink/**** to start your check. Please note this link is unique to you and you should not be sharing it with anyone.

Email invitation sample

You need to tap where it says ‘here’ in blue to start your check. Please note this link is unique to you and you should not be sharing it with anyone.

Why do I need to complete my check in the Checkboard app?

The law.

By law, all buyers and sellers must pass the government’s AML (Anti-money laundering) checks. This is to help stop fraud because of the millions of pounds exchanged between various parties.

A criminal offence can be committed carrying a sentence of up to 14 years imprisonment and a £10,000 fine if AML is not followed.

If you are buying or selling, or both, you must:

1. Pass your Identification and Address check.

At your normal residing address, e.g., to prove your identity has not been stolen.

If you are buying only, in addition, you must:

2). Prove your Source of Funds.

By providing evidence of where your source of purchase funds originated from.

How seriously do Checkboard treat your data?

Very. For your peace of mind, we confirm that not only is Checkboard regulated by the Financial Conduct Authority (FCA) (the same regulator as high street banks), but Checkboard also use government-backed Open Banking technology. That’s how we ensure your financial data is handled safely and securely.

Our approach is to reduce your risk.

Because paper bank statements are at risk of being forged by criminals who may intercept these, the Checkboard app offers government-backed Open Banking technology to access your statements digitally in minutes and in a secure way. Simply follow our steps when prompted by our app.

Helpline?

You shouldn’t get stuck, as Checkboard it’s an easy process, but if you do, use our help facility or call us 0204 566 8106.

- 24 / 7 Online Tracking

- Call Surgery

- Online Payment

- Quote App

- Our Team & Careers

- Conveyancing Today

- Get in touch

- Cheap conveyancing solicitors

- Online conveyancing quote

- Find a conveyancing solicitor

- Solicitors for house buying

- Residential Conveyancing

- Property Conveyancing

- Solicitor Costs For Buying a House

- House Conveyancing

- Conveyancing Guide

- Conveyancing Solicitor

- Residential Solicitors

- Conveyancing