As the buyer’s solicitors this is a document which we prepare and send to the seller. If we are the seller’s solicitor we ensure that the transfer deed has been properly prepared by the buyer. This is a vital document as it passes the ownership of the property from the seller to the buyer. It is dated with the completion date and will be sent to the Land Registry after completion. The Land Registry will use this transfer deed to change their records and show the buyer as the new owner of the property.

Why AVRillo Conveyancing?

Why AVRillo Conveyancing? The conveyancing crisis and the single best way to get to exchange

The conveyancing crisis and the single best way to get to exchange Certainty. Speed. Collaboration

Certainty. Speed. Collaboration Pipeline Crisis

Pipeline Crisis It’s summer, so why do you have to think about Christmas?

It’s summer, so why do you have to think about Christmas? Control your profit, control your conveyancer before it’s too late.

Control your profit, control your conveyancer before it’s too late. Using a sledgehammer to crack a nut

Using a sledgehammer to crack a nut Why AVRillo Conveyancing?

Why AVRillo Conveyancing? Start saving for your rainy day before it’s too late.

Start saving for your rainy day before it’s too late. Conveyancers Control Your Profit. Not You.

Conveyancers Control Your Profit. Not You. Mind Reading

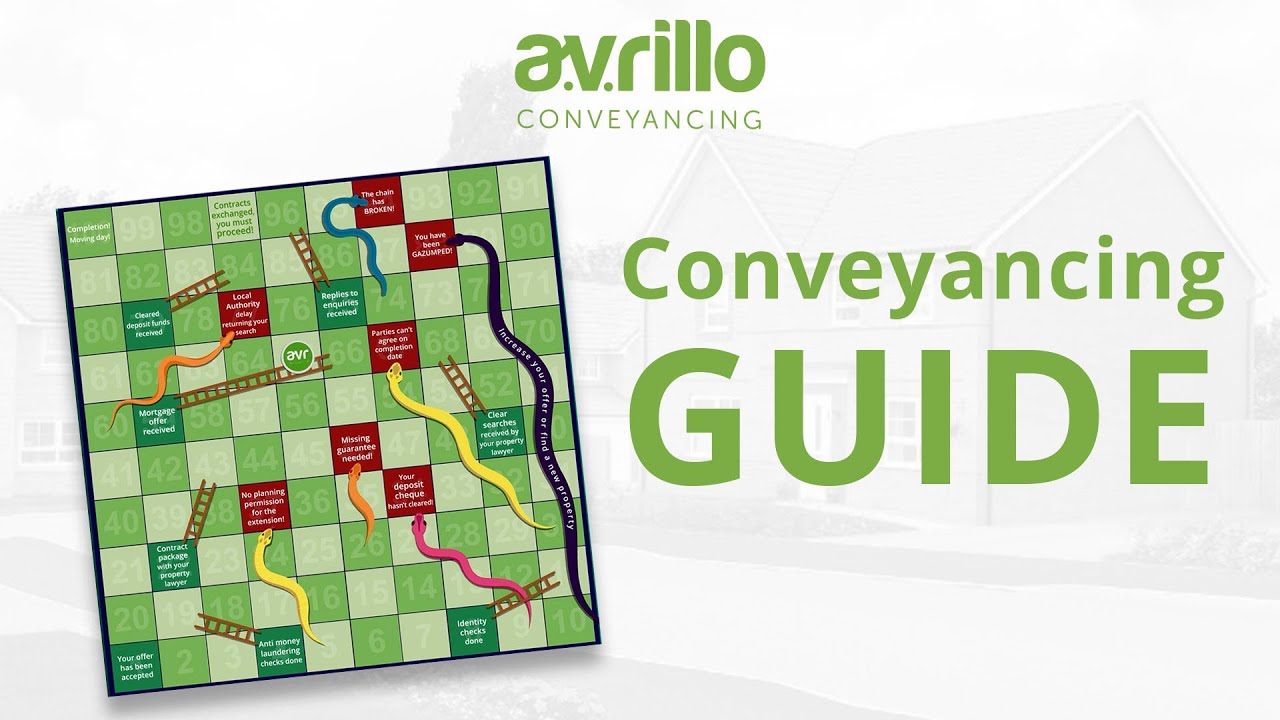

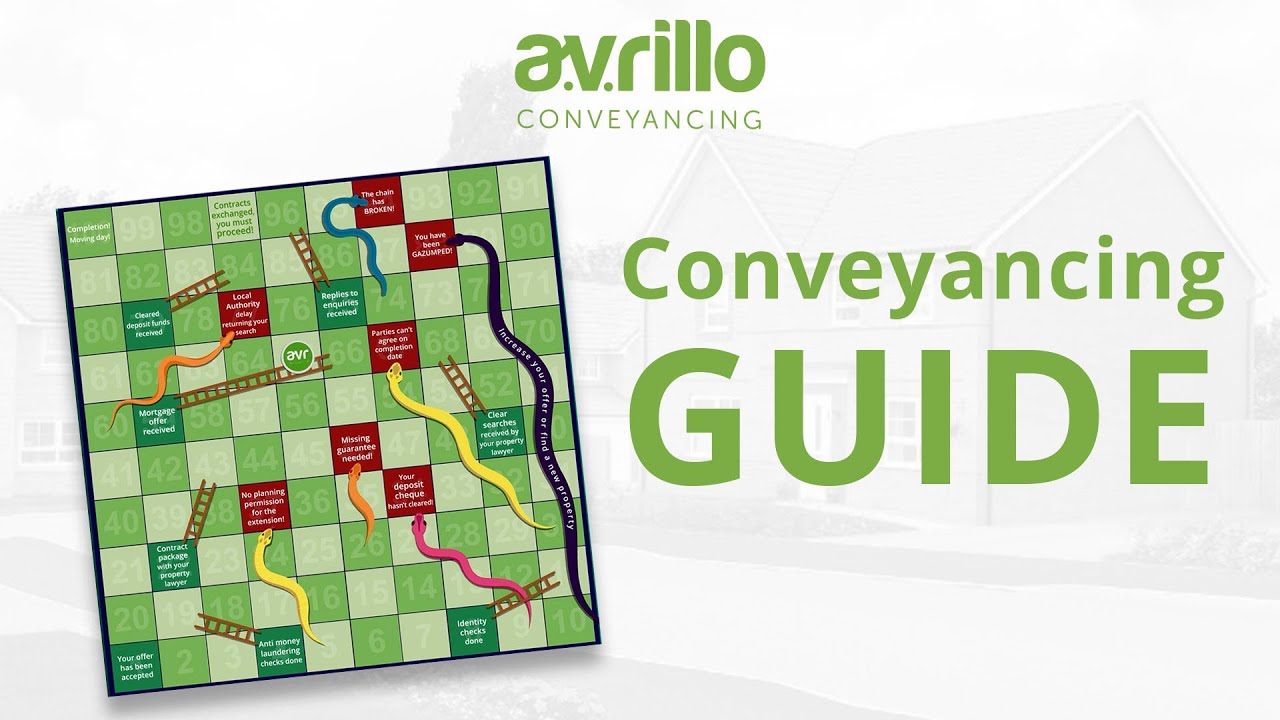

Mind Reading Conveyancing guide. Snakes and ladders!

Conveyancing guide. Snakes and ladders! Move Fast with AVRillo

Move Fast with AVRillo Make sure you are prepared early so you can get to exchange with a quote

Make sure you are prepared early so you can get to exchange with a quote Conveyancing guide. Snakes and ladders!

Conveyancing guide. Snakes and ladders! Move Fast with AVRillo

Move Fast with AVRillo Mind Reading

Mind Reading Conveyancers Control Your Profit. Not You.

Conveyancers Control Your Profit. Not You. The conveyancing crisis and the single best way to get to exchange

The conveyancing crisis and the single best way to get to exchange Start saving for your rainy day before it’s too late.

Start saving for your rainy day before it’s too late. Using a sledgehammer to crack a nut

Using a sledgehammer to crack a nut Control your profit, control your conveyancer before it’s too late.

Control your profit, control your conveyancer before it’s too late. It’s summer, so why do you have to think about Christmas?

It’s summer, so why do you have to think about Christmas? Pipeline Crisis

Pipeline Crisis Certainty. Speed. Collaboration

Certainty. Speed. Collaboration Make sure you are prepared early so you can get to exchange with a quote

Make sure you are prepared early so you can get to exchange with a quote