Housing market continues to slow down

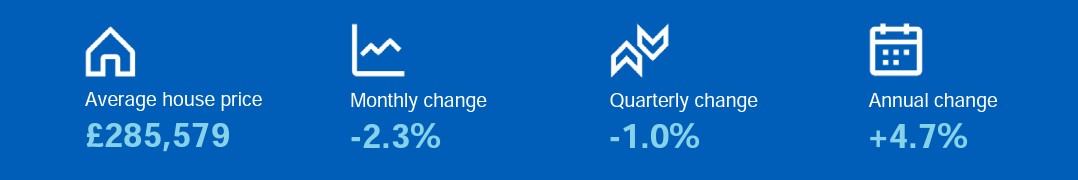

The latest house price figures from Halifax have revealed a concerning decline in prices, with the average home dropping by 2.3% in November compared to October. It is the largest monthly fall since October 2008 and will come as a worry for many involved in conveyancing.

House prices have fallen by 3.5% over the past year. It is the biggest annual drop since October 2008. Prices are now at their lowest level since October 2013. So what’s behind this fall in prices? And what does it mean for buyers, sellers and estate agents?

Kim Kinnaird, director of Halifax Mortgages, stated that though a market slowdown was anticipated due to preexisting economic difficulties. Housing prices have risen 19% since March 2020 – this month’s drop is the most significant market volatility in recent months.

Also read: Process of Buying a House: Timeline & Step By Step Guide

Halifax Average House Price (£’000)

The average price of a home dropped by 2.3% in November compared to the previous month

The cause of the decline is uncertain, but it could be partly attributed to weaker demand in recent months combined with a rise in unemployment due to COVID-19 pandemic-related economic pressures.

With nearly all regions seeing declines over this period, some commentators have predicted further drops going into 2021 due to the still-uncertain economic outlook. Taking action now can help conveyancers stay ahead of the curve and protect their client’s investments through every stage of their conveyancing journey.

By guiding local market conditions, expert conveyancers will help buyers make decisions that are right for them at this difficult time. Ultimately, conveyancing professionals who remain up-to-date on the changing housing market are key players in ensuring their clients achieve success despite these difficult times.

Also read: The Conveyancing Process on the Sale of a Property

Weaker consumer confidence and an increase in properties coming onto the market

The Halifax housing market has seen a two-month decline in house prices according to its latest index, attributed to a decrease in consumer confidence and an increase in the number of properties coming onto the market.

The average house price is £285,579 in December. The property market change is likely due to weak consumer demand and cautious buyers waiting for prices to recover before making a purchase.

Typical of this current trend was a larger supply of properties on the market in December across all regions – up 19% year on year – along with more time needed for properties to sell as an increasing number of homeowners choose to wait and see where prices go rather than selling at a lower rate.

Even though stagnation may still be affecting house prices, this could mean buyers could snap up some good bargains as sellers become increasingly desperate for a quick sale. For now, though, it looks like buyers remain cautious and observers are wary of predicting a potential recession in the housing market.

Also See: How to Appoint a Conveyancing Solicitor

Good time to enter or re-enter the market for the first buyers

Despite declining prices overall there is hope that some localised areas may experience stability or even modest growth as we enter 2020. It will be interesting to keep an eye on how the Halifax Index develops over time and what impact Brexit might have on house prices in both the long and short term. Thus far it looks as if any wider economic uncertainty has had more of an impact than Britain’s exit from the EU.

With housing markets showing signs of a slowdown, many economists are predicting that house prices could continue to decline. That is allowing buyers to get a foot on the property ladder or upgrade their homes more affordably. However, it is important to take into consideration other aspects when deciding whether now is a good time to buy.

Before making any decisions, potential buyers should make sure they have enough savings set aside for any future repairs or extra costs that might appear. It’s also important to do plenty of research on properties and areas before signing off on a purchase agreement. This will help ensure that you acquire the right property at the right price, now and in years to come.

The recent falls in house prices may be off-putting for those considering buying a property. This could be a good time for first-time buyers and those looking to move up the property ladder to enter the market as prices could continue to fall.

Also read: The Cost of Buying a House and Moving